How Instant Payments are Shaping the Future?

Introduction

There once was a time in the realm of payments when waiting days for transactions to process was the norm. Delays, transaction fees, and the constant need for intermediaries became accepted operational hurdles. This age-old paradigm, fraught with inefficiencies and a lack of transparency, limited the growth potential of businesses and often left them at the mercy of a sluggish financial system.

However, the financial industry is in the midst of a transformative shift. Ever since the first coin exchanged hands in ancient marketplaces, banking has evolved, but never has it seen such rapid changes as in the digital age. At the center of this revolution lies the concept of open banking payments - a transformative approach that is fundamentally altering the way businesses can accept payments.

Before diving into the specifics of account to account payments, it's essential to understand the broader landscape of today's payments. The era of waiting days for a payment to process or being encumbered by fees and middlemen is swiftly coming to a close. Modern businesses require real-time solutions, flexibility, and security - all of which are delivered by account to account payment systems.

The sheer speed and efficiency that account to account transactions bring to the table are unparalleled. Traditional banking processes, with their layers of bureaucracy and manual verification, simply cannot compete. With real-time transfers, businesses can improve cash flow, streamline supply chains, and respond with agility to market changes.

Streamlined Processes

The modern business environment is characterised by immediacy and demand for error-free operations. Account to account payments, pioneered by industry leaders like Contiant, deliver on this front. By utilising smart routing algorithms, these systems can find the most efficient and cost-effective pathway for funds, ensuring rapid transfers. Add automation into the mix, and you've got a formula for significantly reducing manual errors, leading to even smoother transactions.

Personalised Services for a Modern Landscape

In today's competitive financial world, a one-size-fits-all approach doesn't cut it. Account to account payments enable financial institutions to tailor their products and services to individual business needs, offering a personalised experience that fosters loyalty and satisfaction.

Strategic Decision Making with Real-Time Data

With instant access to transaction data, businesses can garner insights that were previously out of reach. This real-time data-driven perspective not only aids in immediate decision-making but also in long-term strategic planning, ensuring companies remain several steps ahead of their competition.

Innovation and Expansion

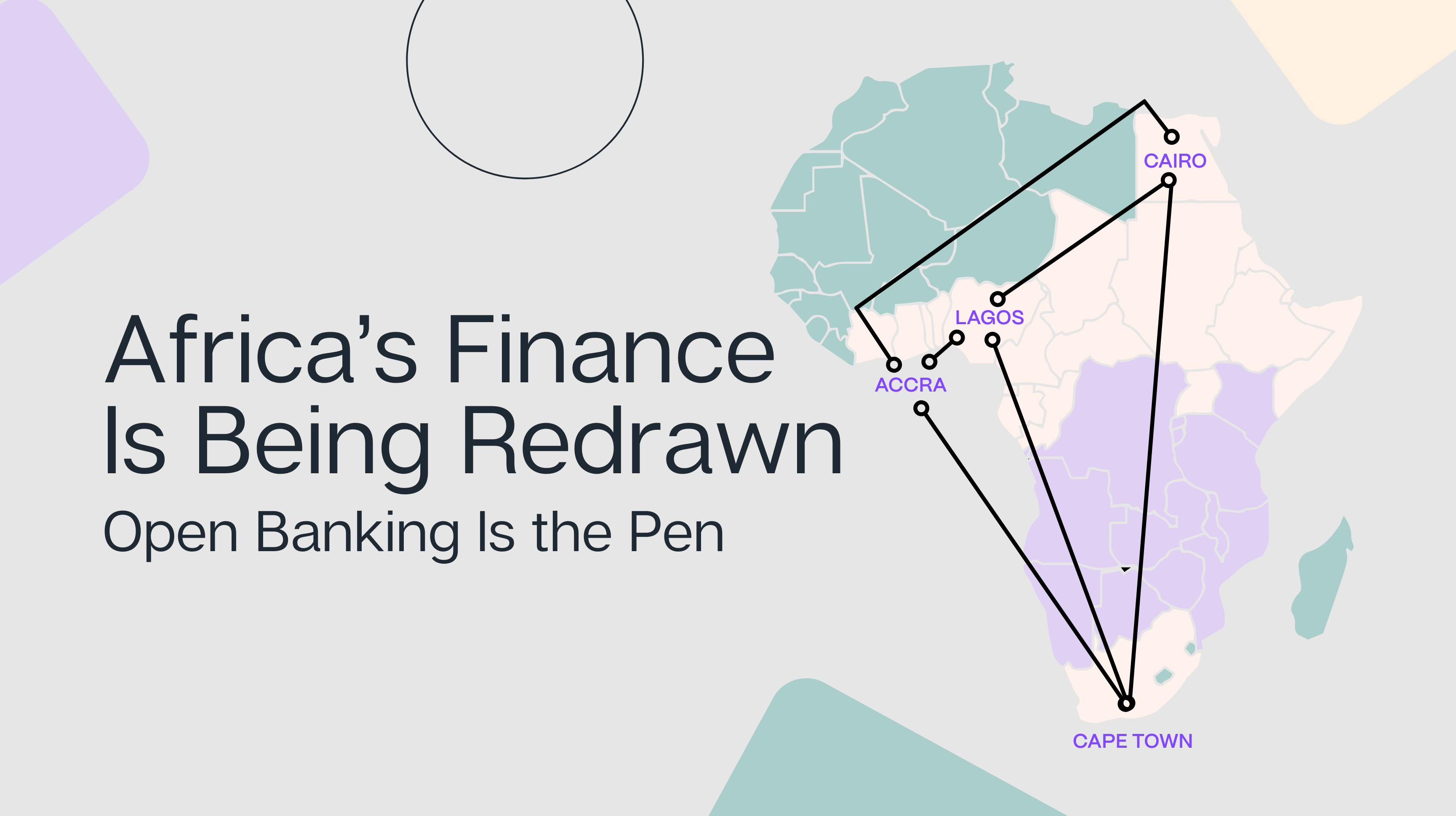

This transformative banking approach doesn't just optimise current processes; it also paves the way for innovation. As businesses harness the power of account to account payments, they're better positioned to develop new products and even expand into previously untapped markets.

Uncompromised Security in a Digital Age

With digital advancements come concerns about security, but leading platforms, such as Contiant's, have this covered. Through state-of-the-art encryption techniques, continuous monitoring, AI-driven fraud detection, and strict adherence to global regulatory standards, businesses can rest assured that their transactions and data are in safe hands.

Interoperability: The Bridge to Global Business

True success in today's business environment means thinking beyond local or even national boundaries. Account to account payment platforms, with their standardised APIs, offer a seamless integration with various financial institutions worldwide. This global reach and cross-platform functionality mean businesses can operate on an international scale with ease.

Conclusion

The realm of business banking is undergoing a seismic shift. Account to account payments, with their myriad benefits, are at the helm of this change. As businesses seek to remain competitive, adapt to market demands, and ensure their operations are as efficient as possible, embracing this evolution is not just advisable—it's imperative.

.png)

.jpg)

.png)

.png)